You might also like:

When it comes to traveling, it can be hard to avoid fees completely. And although many points and miles enthusiasts have resigned themselves to paying some fees, they usually only do so when it offers them something of value in return and when it’s somewhat proportional to the cost of the service. So while I might pay $8 to use in-flight Wi-Fi when I really need to work, I refuse to pay a 3% foreign transaction fee, which is still imposed by many credit cards.

A Short Rant Against Foreign Transaction Fees

Without belaboring the point, here are four reasons why foreign transaction fees are absurd:

1. Banks are raking in 3% (2.7% for Amex) of your foreign purchases, but have effectively zero additional expenses.

2. Arguably, these fees exist only because many cardholders — and even some experienced travelers — don’t know their card has them.

3. There are now dozens of travel rewards credit cards available without these outrageous fees.

4. These fees are even imposed on transactions with foreign companies made from the US, and foreign transactions made in US dollars.

Credit Cards with Foreign Transaction Fees That Need to Go

When I talk to marketing and media relations executives at major credit card issuers, they seem to be aware that their customers hate foreign transaction fees, even though their companies are unwilling to completely drop these charges, which represent pure profit.

That said, pressure from both customers and the media seems to be responsible for the elimination of foreign transaction fees on many travel rewards cards. In fact, last year I wrote about 10 cards that should drop these fees, and four of them actually have! The products in question include the Starwood Preferred Guest Credit Card from American Express, the Citi AAdvantage Platinum Select MasterCard, the Virgin Atlantic Black and White cards from Bank of America and the American Express Gold Card. But as you can see below, the industry still has a ways to go. Here are seven that should be next:

1. Amex EveryDay Preferred Card

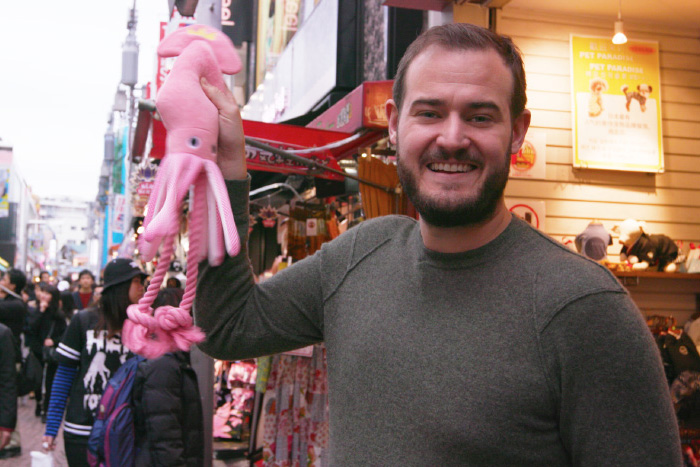

There’s a lot to like about this card, which earns you at least 1.5 points per dollar on all purchases when you use it for at least 30 purchases during a statement period. Better yet, these points are in American Express’ fantastic Membership Rewards program, which allows you to transfer rewards to 17 different airline partners, often with excellent bonuses, like the recently announced 30% bonus for transfers to Etihad. However, as TPG learned the hard way on a recent trip to Tokyo, it still charges a 2.7% foreign transaction fee. Fortunately, that worked out to just about 41 cents on his $15.45 purchase at Harajuku Pet Paradise, but clearly that could have been a much more costly mistake if he had used the card to pay for a hotel stay or even a meal.

So, you’ll want to leave this card at home when making purchases from a foreign company or crossing the border, especially since the 2.7% foreign transaction fee largely negates the value of the Membership Rewards points earned. According to TPG’s latest monthly valuations, Membership Rewards points are worth 1.9 cents each, so even 1.5 points is worth just 2.85 cents per dollar spent (with the 50% points bonus for making 30 transactions in a statement period) — scarcely more than the 2.7% foreign transaction fee.

2. Chase Freedom Unlimited

Like the Amex EveryDay Preferred Card, the Chase Freedom Unlimited offers 1.5 points per dollar spent. But unlike the above product, Freedom Unlimited has no annual fee and doesn’t require any particular transaction volume per statement period to earn 1.5 points per dollar. And although Chase markets this card as a cash-back product, cash back can be moved to a Chase Sapphire Preferred or Ink Plus Business Card account and converted to points which can then be used for transfers to airline miles or hotel points.

With this card offering such a good earning rate for everyday purchases, it’s a shame that Chase still imposes a 3% foreign transaction fee on charges processed outside of the US. Chase has removed foreign transaction fees from just about all of its travel cards, but it appears the issuer introduced this new card with those fees because it doesn’t consider it to be a travel rewards card.

3. Hilton HHonors Surpass Card from American Express

Amex has done a commendable job of ditching foreign transaction fees on many of its travel reward cards, including its Gold Card and Starwood Preferred Guest Credit Card. And while it’s one thing for American Express to impose foreign transaction fee on its Hilton HHonors Card with no annual fee, the 2.7% foreign transaction fee on its premium HHonors Surpass Card with a $75 annual fee is disappointing.

4. Virgin America Visa Signature Card

Virgin America and its banking partner Comenity Capital Bank impose a 3% foreign transaction fee on its its standard Visa Signature Card, which also charges a $49 annual fee. That’s especially disappointing considering the carrier serves Mexico and partners with foreign carriers such as Emirates, Singapore Airlines, Virgin Atlantic and Virgin Australia.

5. Citi AAdvantage Gold MasterCard

I commend Citi for dropping foreign transaction fees on its AAdvantage Platinum Select MasterCard, but it still offers the Gold version with a $50 annual fee and a 3% fee for foreign transactions. If you’re going to charge an annual fee for a card that’s co-branded with a major international carrier (with plenty of international partners), you don’t want to penalize customers for actually using it for their international travel!

6. Citi Hilton HHonors Visa Signature Card

Citi markets this card by saying that “bonus points can be redeemed for hotel stays, premium merchandise and unforgettable experiences in 92 countries.” One unforgettable experience is coming home to learn that you just paid a 3% foreign transaction fee on your overseas purchases. In Citi’s defense, there’s no annual fee for this card, and no foreign transaction fees for its Hilton HHonors Reserve Card with a $95 annual fee.

7. Club Carlson Rewards Visa Signature and Club Carlson Premier Rewards Visa Signature

Once again, a major issuer (in this case, US Bank) offers travel rewards cards affiliated with a company that has significant appeal to overseas travelers, yet it still imposes a ridiculous foreign transaction fee.

In this case, you have to pay 2% of each foreign purchase transaction or foreign ATM advance transaction in US dollars, and 3% of each foreign purchase transaction or foreign ATM advance transaction in a foreign currency, as if there’s actually some difference in the expense of processing foreign transactions in various currencies. Worse, you have to pay these fees regardless of whether you opt for the standard Club Carlson Rewards Visa Signature Card with a $50 annual fee or the Club Carlson Premier Rewards Visa Signature Card with a $75 annual fee. (Technically, these are two separate cards, but because they offer similar benefits I’ve grouped them as one item.)

Bottom Line

Unfortunately, plenty of otherwise great travel rewards cards continue to charge foreign transaction fees, making them poor options for overseas travel. The positive news is that there’s no shortage of cards that waive these fees — from the Chase Sapphire Preferred Card to the Starwood Preferred Guest Credit Card from American Express — that still earn you valuable rewards. For more options, don’t forget to check out this post with 11 great FTF-free cards.

Source: thepointsguy.com