You might also like:

Thus far, 2018 has proven to be a prosperous year for many in the industry, thanks in no small part to the strength of the U.S. economy.

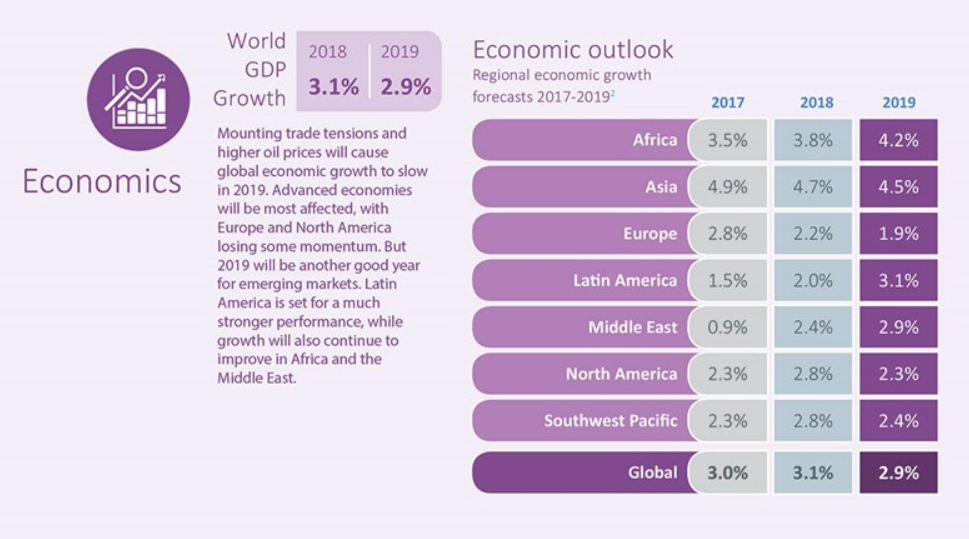

And while economists are predicting a slowdown in growth next year, the next 12 months, barring unforeseeable incidents, should remain strong, with few signs of a pullback on the horizon.

“The economy is clearly strong,” said Andrew Lo, a professor at MIT’s Sloan School of Management and director of the MIT Laboratory for Financial Engineering. “We’ve got pretty low unemployment, very reasonable inflation, and all eyes are on the stock market, which has done quite well. I think, overall, both in the United States and more broadly around the world, things are going quite well. In that kind of an environment, it’s no wonder people are confident about the future and willing to spend money on things like vacation and travel.”

There is little doubt the travel industry is benefiting from the strong economy, with many networks reporting record sales years. For example, Oasis Travel Network recently said it has seen a “noteworthy rise in business in recent months” and saw an “unprecedented jump” in bookings and sales in July, with cruise bookings up 108% year over year and land sales up 25%.

The health of business travel, too, is largely tied to the economy.

Mike Eggleton, senior manager of analytics and research at BCD Travel, asserted, “There’s a pretty compelling correlation between the performance of the U.S. economy and growth in spending by businesses on domestic travel.”

Both 2016 and 2017 saw strong 6% growth in spending on business travel, said Eggleton, who was the primary author of BCD’s 2019 Industry Forecast released in September. That growth slowed a little in 2018, to 4.5%, a rate that is expected to stay level in the coming year.

According to BCD’s forecast, U.S. economic growth is expected to strengthen to 3% in 2018, up from 2.3% in 2017, thanks to a number of factors, including a healthy labor market, consumer spending and investment in business.

“The U.S. economy was in really good shape when Trump came to power, and that economic momentum has been boosted by some of the things he has done, like the tax cuts and Jobs Act and the Bipartisan Budget Act,” Eggleton said.

Brian Schaitkin, senior economist with the Conference Board, also pointed to a number of factors contributing to today’s strong economy: the strength of business and consumer confidence, “at highs for more than a decade each,” and an unemployment rate of 3.9%, the lowest since the late 1990s.

“What you have is a situation where the number of people who feel confident about their job prospects is much higher,” Schaitkin said. “That’s leading to more and more consumption, and when people have more money to spend, they spend that extra income on discretionary items, typically. Of course, travel and leisure is a key part of that.”

The economy took a long time to recover following the Great Recession that began in 2008, Schaitkin said. A number of things needed to happen to enable that recovery. Businesses were conservative in investments in an uncertain environment, as were consumers. Consumers had lower incomes and net worth, so their spending on consumption of things like travel was down.

“The process of getting people’s credit back in order, the labor market back in order, all of that took a long, long time,” he said.

Evidence of the economy growing more quickly emerged around 2016, and it has accelerated since then. Tax cuts and cuts to government programs by the Trump administration this year added to the strong economy.

MIT’s Lo also pointed to population growth and a productive workforce as well as technological innovations fueling new jobs and opportunities for investors.

According to Eggleton, growth in the U.S. economy is expected to slow a bit in 2019, but “that’s not a problem. That’s more of a shift into a moderate growth mode.”

Lo pointed to a number of risks the economy faces going forward, including potential political instability, inflation, rising interest rates and the potential for the economy to cool too quickly and cause a small recession.

“But so far,” he said, “it doesn’t look like that’s as much of a risk as it might have been in the past. So as long as we don’t see any geopolitical issues or tremendous political instability, I think we should be in good shape.”

Asked how long that will last, Lo predicted that the economy will at least be in “reasonable shape” for the next six to 12 months.

“If you look at the jobs numbers, housing starts, inflation and Fed policy, we’re still in a period of relatively low interest rates, and business is still growing,” he said.

Geopolitical disruptions remain one of the biggest risks, according to Lo. For example, a significant conflict with North Korea could cause a pullback of business growth.

“But apart from that, I think that certainly all indications point to strong growth through the end of this year and hopefully into next,” he said.

Schaitkin also predicted the growth of the economy will likely slow going forward. The chances of another recession are “fairly low” over the course of the next year.

“We already know that the labor market is pretty strong,” he said. “There are not any clear financial market imbalances that seem like they’re going to trigger a domestic or global financial crisis in the near term.”

Interest rates will be raised, he said, but it would take an “unexpected shock” to trigger a recession in the near-term. As an example, he cited 2000-2001, when the shock was overinvestment in new technology firms that resulted in the bursting of the dot-com bubble.

“It’s hard to say what exactly that shock will be,” Schaitkin said. “But history suggests that that shock will indeed come eventually.”

Source: travelweekly.com