You might also like:

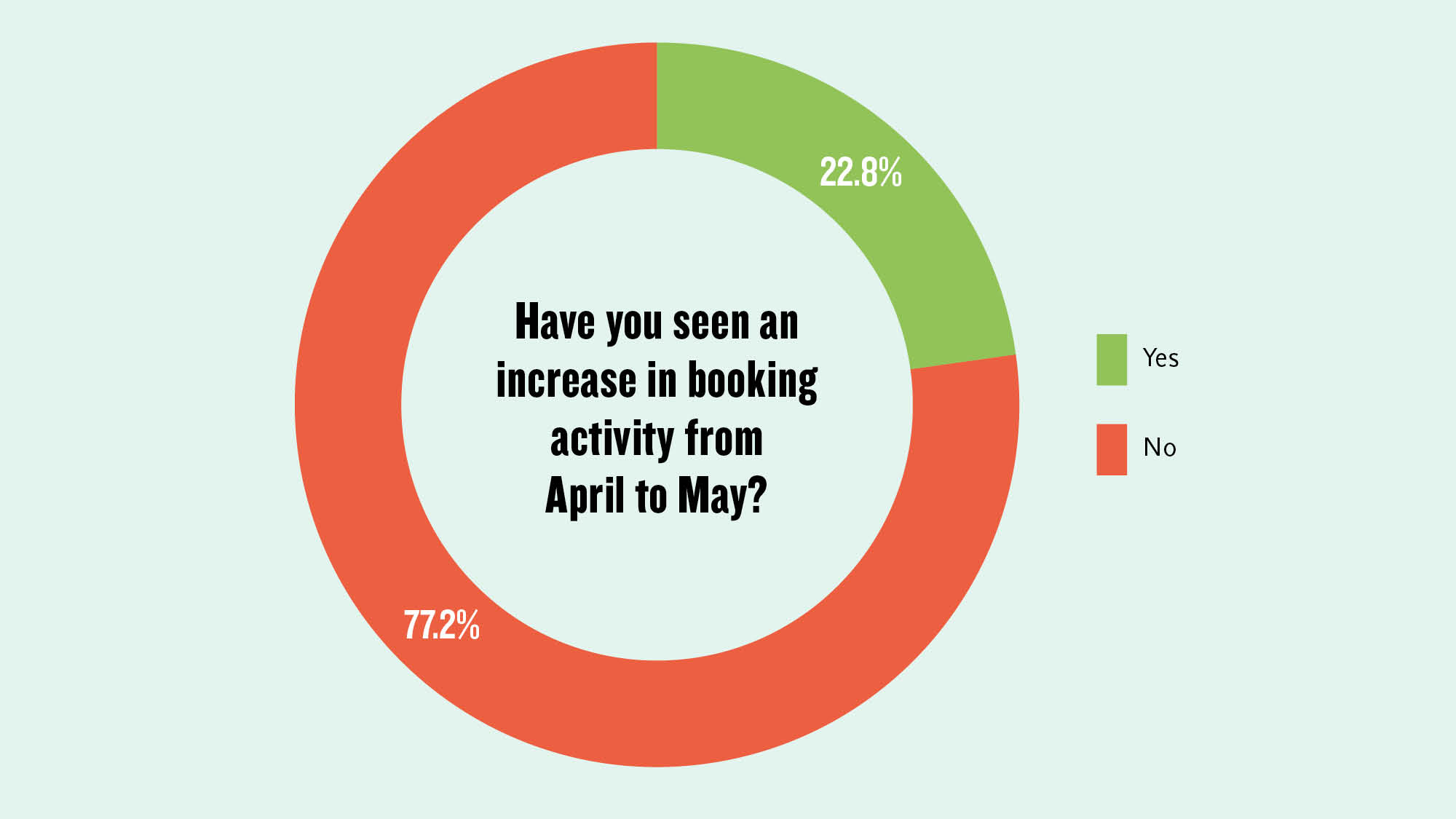

While the Covid-19 travel recovery is largely expected to start locally and grow regionally, few advisors are reporting a rise in domestic bookings since the pandemic shut down global travel, according to the latest Travel Weekly survey.

Although one respondent noted that “car travel appears to be garnering the most interest right now” and “domestic travel inquiries are [outnumbering international] 5-to-1,” only 17.1% of survey respondents said they had seen an increase in domestic reservations. Of those reporting rising bookings for the U.S., nearly 70% said the increase was less than 10% above their domestic bookings in the same period last year.

The findings appear to underscore not only traditional agencies’ focus on cruise and international bookings but also how much that could change as wholesalers, tour operators and advisors themselves scurry to develop domestic and regional products that target travelers eager to escape their homes, albeit cautiously.

Island Destinations, for instance, one of the top luxury wholesalers specializing in beach resorts around the world, has renamed its company ID Travel Group and has turned its focus to domestic and regional destinations.

This week, it unveiled a private luxury camp program that agents can white label to sell packages at more than 20 mostly domestic resorts, such as Montana’s Resort at Paws Up and Watch Hill in Rhode Island, complete with a private camp counselor to keep the kids busy but socially distanced while their parents relax or work.

“The big story here is that advisors were calling us saying, ‘This is what we are getting demand for. Can you help us?'” said ID Travel Group COO Laurie Palumbo.

“Here the ‘island destination’ we are selling is Chatham Bars Inn [on Cape Cod] and Amangiri in the [Utah] desert.”

Likewise, other wholesalers who have traditionally sold little domestic product to advisors in the U.S. are switching gears and putting more U.S. hotels and product in front of U.S. agents.

And tour operators also are increasing their domestic offerings. Abercrombie & Kent last week added six Tailor Made adventures across the American West and Alaska as well as two Great American Road Trips with private guides and carefully vetted accommodations that offer added space and privacy.

Globus and Intrepid have said they will in coming weeks unveil domestic products not just for the U.S. market but also for clients in key markets in Australia and the U.K.

“In theory, you don’t sell local destinations to locals,” said Felix Brambilla, CEO of Overseas Leisure Group. “When you talk to most travel advisors in the U.S., their strength is in outbound, in sending people to Africa and so on. They know the key properties in the U.S. But now they are way more than a weekend getaway; they are becoming a real priority destination for everyone.”

Steven Kadoch, managing partner of Ultimate Jet Vacations, which traditionally sells mostly the Caribbean and Mexico, said he has been focused in recent weeks on adding hotels and destination getaways across the country to their inventory.

“We’re not new to the domestic product,” Kadoch said, but with recent additions such as Ted Turner Reserves in New Mexico, the Lodge at Blue Sky in Montana and the Caldera House in Wyoming, “we’ve been beefing it up, for sure.”

Brambilla, whose company traditionally focused on selling inbound U.S. packages to agents in Latin America, Europe and the Middle East, said he has added 1,200 U.S. hotels along with a host of new experiences to his inventory under the company’s new, no-deposit Carefree Bookings program and expects that the sales of domestic properties by U.S. agents could go from 5% of his business to 75%.

Jack Ezon, founder and managing partner of Embark Beyond, said he expects a similar shift in business at his agency.

“As a retailer, Embark historically only sold less than 8% domestically,” he said. “We project 85% for the rest of the year, and [we’re] focusing on a ‘discover your homeland’ campaign. We’ve spent sleepless nights [updating] our internal resources, whipping together seminars and tools to get everyone up to speed.”

Embark was one of the first agencies to feature ID Travel Group’s camp program, and it had more than 70 inquires in the first days it was featured on its website, Ezon said. It “literally flooded us,” he said.

Misty Ewing Belles, managing director of public relations for Virtuoso, said agencies that are part of their consortia haven’t traditionally booked much domestic, other than Hawaii.

“It’s not really our bread and butter,” she said. “However, I think times have changed.”

She said the value of advisors was highlighted by the travel shutdown, which left so many travelers stranded and others scurrying to change plans.

“People used to say I can plan my own trip to Orlando or California,” she said. “But anytime there is a crisis, it highlights the value of a travel advisor — and this time it’s 10 times more.”

Source: travelweekly.com