You might also like:

Ahead of the Africa Hotel Investment Forum, STR has highlighted Africa’s key hotel development and performance trends.

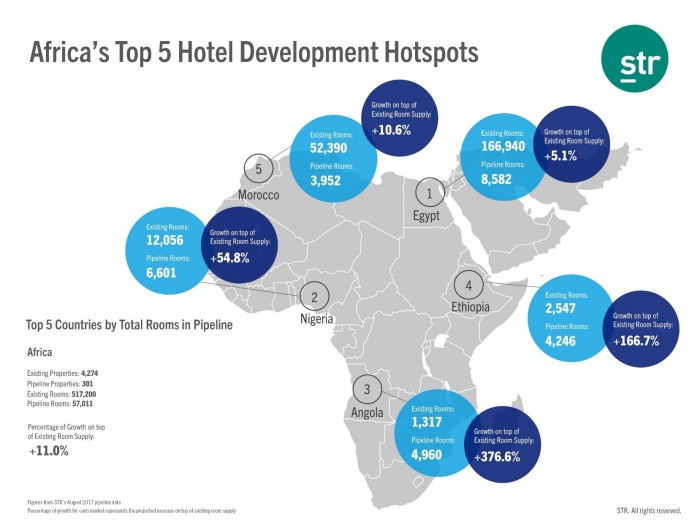

Based on August 2017 data, Africa currently shows 301 hotel projects in the pipeline, accounting for 57,011 rooms, or 11 per cent of the continent’s existing room supply.

Ahead of his AHIF presentation on Wednesday, October 11th, Thomas Emanuel, STR’s director of business development, commented on recent performance trends in the market.

“Across Africa, we’ve seen mixed performance results to date,” Emanuel said.

“In local currencies, rates are up in several countries, including Egypt, Morocco and South Africa, but in many instances, you need to consider exchange rates to see the full picture.

“Meanwhile, some other markets are already experiencing performance declines as a result of supply growth, such as Nigeria, Ethiopia and Algeria, so it will be very interesting to see how these markets respond as more rooms continue to come online.”

As of August, Egypt hotels posted a 70.1 per cent increase in average daily rate to EGP1,185.53.

While the country’s ADR has remained above EGP1,000 each month since November 2016, the devaluation of the Egyptian pound has significantly inflated figures.

When reported in US dollars, Egypt’s ADR declined 17.2 per cent for the January to August 2017 time period, dropping to an actual level of US$66.54.

Occupancy, on the other hand, rose 17.2 per cent to 52.7 per cent.

At the market level, Cairo posted an 8.5 per cent increase in occupancy and a 72.5 per cent increase in ADR (down 16.2 per cent in US dollars), resulting in 87.2 per cent growth in revenue per available room to EGP997.58.

Although Sharm El Sheikh recorded a 13.9 per cent increase in occupancy for the first eight months of the year, the market’s actual occupancy level was only 40.4 per cent.

STR analysts note that security concerns continue to hinder Sharm El Sheik’s hotel demand.

With the current pipeline representing more than half of the market’s existing hotel rooms, STR analysts expect that supply growth will continue pressuring Nigeria’s occupancy levels in the near future.

August year-to-date data shows a 1.2 per cent decline in occupancy to 44.3 per cent but a 6.8 per cent increase in ADR to NGN47,819.53.

When measured in US dollars, however, ADR declined 23.3 per cent to US$149.58.

The market currently faces several challenges, with security concerns as well as struggles in Lagos due to the low oil prices.

Hotels in Ethiopia have experienced mixed performance levels thus far in 2017, with occupancy down 6.7 per cent to 51.6 per cent and ADR up eight per cent to ETB4,914.13.

STR analysts note that the country’s number of room nights available increased 4.2 per cent compared with the first eight months of 2016, which has affected occupancy levels.

For the month of August, RevPAR was down 5.4 per cent to ETB1,834.81, mainly the result of a 4.2 per cent drop in occupancy.

Rate performance has been stronger on weekdays than weekends this year, indicating growth in corporate business, but occupancy levels are down for both weekdays and weekends.

STR’s data sample in the hotel industry comprises more than 58,000 hotels and 7.8 million hotel rooms around the world.

Pipeline data reported by STR is gathered from major chains, proprietary software, management companies and independent sources.

Sоurсе: breakingtravelnews.com