You might also like:

Disclaimer: This is not a post explaining why you should get the Centurion Card (if offered). It’s simply the reasoning behind why I decided to take the plunge in my unique circumstances.

1. There Is A Lack Of Quality Information About The Card

As an invitation-only card, there isn’t much publicly known about it. American Express refuses to comment publicly and while there are internet forums that discuss the card, the information isn’t verified and per the internet, there are a lot of trolls who don’t have the card, but post as if they do.

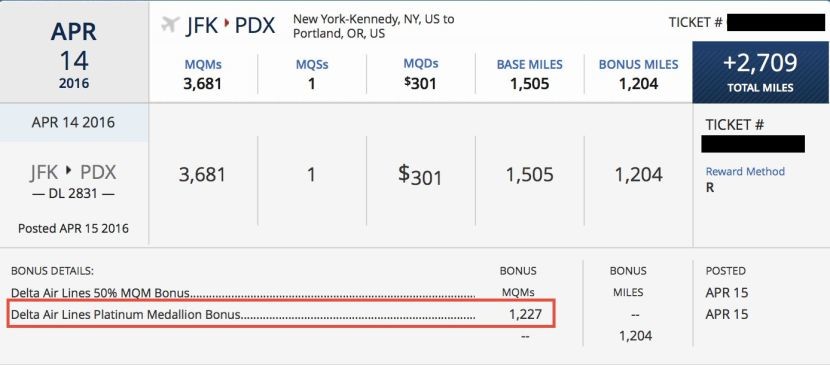

Much of the information that was known about the card before wasn’t even entirely accurate — and some of those who don’t have the card seem to have some inaccurate information about it as well. In a post on my friend Gary’s blog, it was stated with certitude that the card was useless; that you “don’t really get Delta Platinum status because you don’t get bonus miles for flights.” However, as a cardholder who recently flew Delta with my comped Centurion status, I can confirm that the Platinum bonus was credited.

On a $301 flight, Delta would have only awarded me 1,505 miles for the flight since I had no status before, but because of my Centurion card I got an additional 1,227 miles. Sure that’s worth about $14.72 in value per my most recent valuations, but the value increases, especially if you’re buying international business-class fares, which contrary to many frugal bloggers’ beliefs, people do. And you don’t need to use your Centurion card to get the Platinum benefit — you can still use a Premier Rewards Gold to book a $5,000 DeltaOne ticket and get 45,000 SkyMiles total versus 25,000 as a non-elite, plus you’ll earn 15,000 Amex points since you’re getting 3x with PRG.

I’ve already saved a ton of money rebooking award tickets that I had booked at the mid-tier for an upcoming trip to Ghana for PeaceJam. Delta released a ton of 70,000-mile one-way tickets on our day of travel, so I rebooked our group on the nonstop JFK-ACC flight, which saves us time and money. It would have cost me $150 per person to re-ticket at the lower rate, but thanks to my new Platinum status, it was free. I’m sure I’ll take advantage of this many more times, saving me $150 every time I change or redeposit an award ticket.

The Delta Platinum status is far from worthless if you know how to maximize it (like all things miles and points).

2. Content

As a blog in a very competitive field, TPG needs to create unique content that sets it apart from others. As The Points Guy and watching the site and our staff grow from 2010 when I first started, my main goal has always been to help readers by creating unique content, which has worked since we just hit 2.7 million monthly unique visitors — more than almost every other travel and credit card comparison website.

To keep growing you need to be different. Many of our competitors cannot get the Centurion Card, so when I was invited, I jumped at the opportunity as a chance to let you, our readers, know about something that’s probably out of reach for the average person, but still entertaining to read about nonetheless. Just wait until you see what I’m tasking my dedicated Centurion concierge to do!

And there’s proof that people are interested in the card: My video weighing the card against its heavyweight competitors was our number one post on Friday, and my Travel + Leisure piece was number one on that site when it was published — and on the list of T+L‘s top posts for the week. So be on the lookout for more analysis and content to come.

3. Putting the Perks to the Test

The Centurion Card is not about points — it’s about perks and service. One of the most exciting perks, to me, is the dedicated concierge service. Each Centurion cardholder is given access to the dedicated Amex Centurion concierge service. So far, the service has been everything I expected and more — in the instances where I’ve needed to contact the concierge, I’ve been impressed with the service and the outcomes the concierge has been able to report back to me with.

Each Centurion cardholder isn’t given a dedicated concierge, instead, you just call in and get the first available representative. But, I’ve used the same concierge multiple times and now his direct line and email are the first I turn to when I need concierge service. I haven’t written a post on this service yet because I’m still testing out the perks and what they can do, so stay tuned.

4. Business Expense

Without going into too much detail, since I run a credit card website and I got this card to write about, this is a business expense for me so the actual cost is nowhere near the full amount. So while $10,000 might seem like an insane amount of money for a person to spend, being able to expense most of that cost was more reason for me to sign up for the card.

5. I Think Centurion is on the Up and Up

Amex, as a company, is going through some interesting changes right now. If you look at recent Amex news, there hasn’t been much reason to get excited. Last year, it was announced that Costco was dropping Amex in favor of Visa — a huge loss for Amex, given the popularity of Costco. There have also been rumors that SPG is dropping Amex as its issuer.

Because of these recent downfalls, I can see Amex ramping up luxury consumer benefits like they’ve done with Centurion Lounges, which are one of my favorite lounges when I’m at the airport (you’ll also get access with the Amex Platinum card). With all the luxury benefits of the card, and the possibility of Amex adding additional perks, I think for that reason alone the card could be worth the $2,500 annual fee.

Bottom Line

Only time will tell, but the main reason I got the card isn’t so I can stroke my ego and use it to buy my coffee. In fact, I use my my Chase Sapphire Preferred or Amex Everyday Preferred for most of my regular purchases. This post is not meant to confirm that the cost is worth it, but instead to explain a little further how I justified the cost to get it.

Stay tuned!

Source: thepointsguy.com