You might also like:

When it comes to no-fee Chase cards, lately the Chase Freedom Unlimited has been enjoying the spotlight. This recently announced card offers a flat 1.5% cash back on every purchase — or 1.5x Ultimate Rewards points if you have a UR-earning card, such as Chase Sapphire Preferred. While the Freedom Unlimited card is definitely worth considering if you’re looking to maximize everyday, non-bonus-category spending, another product in Chase’s lineup is also worth a look, especially if you want a solid no-fee product for business purchases: the Ink Cash Business Card.

1. No Annual Fee

Especially if you hold well over a dozen travel rewards cards like TPG, credit card annual fees can really add up. While there’s often value in paying several hundred dollars a year for premium cards with airline fee waivers and other money-saving benefits, no-fee cards are hardly slackers when it comes to earning travel rewards. The Ink Cash Business Card is in good no-fee company, with standout products like the original Chase Freedom Card and the Citi Double Cash Card also offering the opportunity to earn elevated cash-back rewards without needing to pay anything each account membership year.

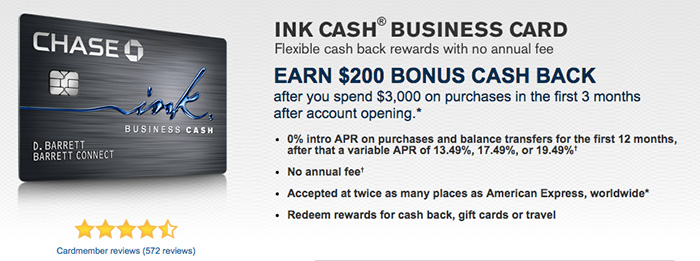

2. A $200 or 20,000-Point Sign-Up Bonus

You can enjoy the previously mentioned sign-up bonus as simple cash back or, as in the case of the Chase Freedom and Freedom Unlimited, you can turn it into 20,000 Ultimate Rewards points if you pair the Ink Cash Business Card with a card that earns UR points, such as the Chase Sapphire Preferred Card or the Ink Plus Business Card.

According to TPG’s latest monthly valuations, 20,000 Ultimate Rewards points are worth $420 — more than twice the cash-back amount. Due to the Ultimate Rewards program’s great selection of transfer partners, those points can get you far. For more information, see TPG Contributor Richard Kerr’s post, Redeeming Chase Ultimate Rewards Points for Maximum Value.

3. Earn up to 5% Back on the First $25,000 Spent in Certain Categories

Apart from the lack of an annual fee, one of the biggest reasons to consider the Ink Cash Business Card is that you can earn 5% cash back on the first $25,000 spent in combined purchases at office supply stores and on cellular phone, landline, internet and cable TV services each account anniversary year. You’ll also earn 2% cash back on the first $25,000 spent in combined purchases at gas stations and restaurants each account anniversary year, and you’ll get an unlimited 1% cash back on everything else.

Due to the ability to translate cash back from this card into Ultimate Rewards points by pairing it with other Chase products, you could effectively earn a return of 10.5% percent (based on TPG’s valuations) for the first $25,000 spent at office supply stores and on the other services mentioned above, and 4.2% on the first $25,000 spent at gas stations and restaurants. For everyday, non-bonus spending, where there’s no cap to your earnings, that equals a pretty solid 2.1% return. This is especially great for a no-fee card, and you might consider stacking this with the Ink Plus Business Card, which offers 5x, 2x and 1x points (not cash back) on similar categories, but with a higher cap of $50,000 in combined spending for each of the earning categories each year.

4. Many People Can Apply

When you see a product advertised as a business card, you may think you’re not eligible to apply — but you’re more likely to meet the requirements than you think. You don’t need to have a formal business to be eligible; if you’re a freelancer or you have a side gig, for example, you should consider applying (provided you meet the other requirements for a given product). In fact, you don’t need a Federal Employer Identification Number (EIN) to apply for most business products, since most issuers let you use your Social Security Number instead.

5. It Doesn’t Appear As an Account on Your Personal Credit Report

When you apply for a business card like the Ink Cash, it will count as an inquiry on your personal account, but the credit line will sit on a business credit report separate from your personal one. This means that the additional credit you receive when you’re accepted for the card won’t affect your utilization ratio, which is a huge factor of your credit score.

6. 0% Introductory APR

Carrying a balance is never ideal, but if you need to do so for your business expenses, it helps that the Ink Cash Business Card offers 0% intro APR on purchases and balance transfers for the first 12 months. After that timeframe, it will jump to a variable rate of 13.49%, 17.49% or 19.49% — at which point it’s definitely worth avoiding in favor of other, more affordable options. For example, cards like the Amex EveryDay Credit Card from American Express offer 0% APR on purchases and balance transfers for the first 15 months.

7. Purchase Protection and Extended Warranty

If you want some security when making purchases, this card could also be a solid option. It offers purchase protection, covering newly bought items for 120 days against damage or theft (up to $10,000 per claim and up to $50,000 per account).

As a cardmember you’ll also enjoy extended warranty for eligible purchases, as the card extends the US manufacturer’s warranty by an additional year (on eligible warranties of three years or less). For more information about extended warranties, see this TPG reader success story about using this credit card feature to save money on a repair.

8. Primary (Business) Rental Car Coverage

A final perk of holding the Ink Cash Business Card is that it offers an auto collision damage waiver. Essentially, when you rent a car for business purposes and charge it to this card, you can decline the rental car company’s collision insurance and be covered by the card in the case of theft or collision damage. This is valid on most rentals both in the US and abroad — make sure to check the fine print for more details.

Note that if you’re renting a car for personal use, the Ink Cash won’t be of use. In that case, Chase Sapphire Preferred, which offers primary rental car insurance, would be a better option.

Bottom Line

Thanks to its elevated earning rates for select spending categories and the ability to transfer cash back into valuable Ultimate Rewards points, the Ink Cash Business Card is a no-fee product worth considering. Hopefully this post has given you some ideas on how to maximize the card and its various perks.

Source: thepointsguy.com