You might also like:

Today American Express is adding a new cash-back business card to its product lineup: the SimplyCash Plus Business Card. Read on for the full details.

Offer Details

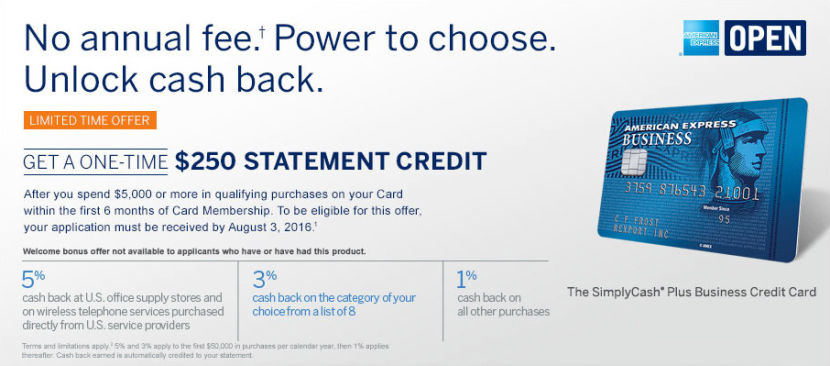

As for the sign-up bonus, this new product is offering a $250 statement credit after you spend $5,000 or more in the first six months of cardmembership. While that may seem like a high spending requirement — especially for a no-fee card — note that the timeframe of six months is double that of most sign-up bonus offers. American Express also states that your card application must be received by August 3, 2016 for you to receive this bonus offer.

Here are the full card details:

- Limited-time offer: Earn a one-time $250 statement credit after you spend $5,000 or more in qualifying purchases on your card within the first six months of cardmembership

- To be eligible for this offer, your application must be received by August 3, 2016

- No annual fee. Plus, more buying power and more cash back

- 5% cash back on wireless telephone services purchased directly from US service providers and US office supply stores

- 3% on the category of your choice from a list of eight and 1% cash back on other purchases

- 5% and 3% apply to the first $50,000 in purchases per calendar year, then 1% thereafter. Cash back received is automatically credited to your account.

Compared to the SimplyCash Business Card, the new SimplyCash Plus Business Card offers a few advantages. First, you can earn 3% and 5% cash back on the first $50,000 spent within the bonus categories per calendar year, while the other card caps those earning rates at the first $25,000.

The other big differentiator is what Amex calls “more buying power.” Essentially, with the SimplyCash Plus Card, you have the flexibility to make big purchases for your business even if they require going over your credit limit. The amount you can spend above the established limit isn’t uncapped; it changes based on your payment history, credit record, income and other factors — and you have to pay off the amount spent over your credit limit in full each month a la charge cards. Amex says there are no over-limit fees, and you don’t have to call in before spending over your limit, so the process should be rather seamless. Finally, Amex says you’ll earn cash back on all purchases — even if they go above your credit limit, so there’s plenty of opportunity to earn rewards.

Is It Worth It?

For business users who want to earn a solid return on purchases in a variety of spending categories, the SimplyCash Plus Business Card from American Express could represent a good value. The cash-back rates of 3% and 5% for bonus spending categories are generous, as is the $50,000 cap for earning them per calendar year. With a higher limit for earning cash back at these rates and the ability to spend beyond your credit limit for big purchases, this new product is definitely a more appealing option than the SimplyCash Business Card — especially since both products carry no annual fee, so there’s really no reason not to choose the newer product.

That said, depending on your award travel priorities, you might want to look elsewhere to cash-back cards that can earn you points rather than just money back in your account. For instance, the following product from Chase earns you cash back, but you can also choose to redeem cash back as Ultimate Rewards points, which can be transferred to various travel partners:

If you’re not set on earning cash back, you might want to look into the Ink Plus Business Card from Chase as well. This card carries a $95 annual fee, but it earns you 5x Ultimate Rewards points on the first $50,000 spent in combined purchases at office supply stores and on cellular phone, landline, internet and cable TV services each account anniversary year, plus 2x points on the first $50,000 spent in combined purchases at gas stations and at hotel accommodations each account anniversary year. Since TPG values Ultimate Reward points at 2.1 cents apiece, you can get a stellar 10.5% return on the first $50,000 spent in the 5x category each year. Again, it all depends on your priorities — some people prefer straight cash back to rewards that can be redeemed toward future travel — but if you can maximize the bonus categories and use points toward hotels and flights that would be more expensive out of pocket, one of these products might be a better choice.

Bottom Line

The new SimplyCash Plus Business Card from American Express offers up to a 5% return on business-related spending, and if you’re looking to earn straight cash back without paying an annual fee, this could be a compelling choice. The ability to make purchases above your credit limit could come in handy when you’re growing your business, too — just remember to pay off the amount above your limit in full each month.

If you’re more interested in earning rewards that can be put toward future travel, though, this card isn’t your best option. The no-fee Ink Cash Business Card offers you the flexibility to earn either cash back or rewards, and has similar elevated bonus categories. And in terms of return on spending, the Ink Plus Business Card is hard to beat for office supply, cellular, TV and internet services, as it earns you a respectable 10.5% on the first $50,000 spent each account anniversary year.

Ultimately, it comes down to your spending habits and earning preferences, but in any case the SimplyCash Plus Business Card is a welcome addition to the Amex lineup of cash-back products. Just remember to apply before August 3, 2016 to get $250 back after spending $5,000 in the first six months.

Source: thepointsguy.com