You might also like:

While the end of the U.S. carry-on laptop ban was welcome news last week for Emirates, Etihad and Qatar Airways, the Gulf carriers continue to face numerous headwinds that have already slowed growth and pushed down profit margins.

“The laptop/large electronic device ban had questionable impacts to begin with,” said Will Horton, senior Middle East analyst for the Sydney-based Centre for Aviation (CAPA). “It was only for flights from the hub to the U.S., and only some passengers would switch airlines because of preference or being unable to physically travel with their device.”

More concerning for the Gulf carriers has been the weak energy sector, which has softened corporate demand in the Middle East. The carriers also face sharply declining ticket prices in key markets, including Asia-Europe and Asia-Middle East, as well as overcapacity within their own region, much of which has been driven by continued expansion by Qatar Airways, Horton said.

Meanwhile, the diplomatic dispute that erupted last month between Qatar on one side and United Arab Emirates (UAE), Bahrain, Egypt, Saudi Arabia, Yemen and the Maldives on the other, has disrupted Qatar Airways’ operations and has brought a halt to commuter flights between Doha and the UAE airports in Dubai and Abu Dhabi, which Emirates and Etihad, respectively, call home.

Finally, Etihad must decide on a new strategy forward as it reels from the May bankruptcy filing of Alitalia, of which it owned 49%, and the ongoing difficulties at Air Berlin, of which it owns 29.2%.

These concerns have already had a demonstrable effect on the Gulf airlines, despite their worldwide reputations for service excellence that have helped make them among the most popular, and recognizable, brands in commercial aviation.

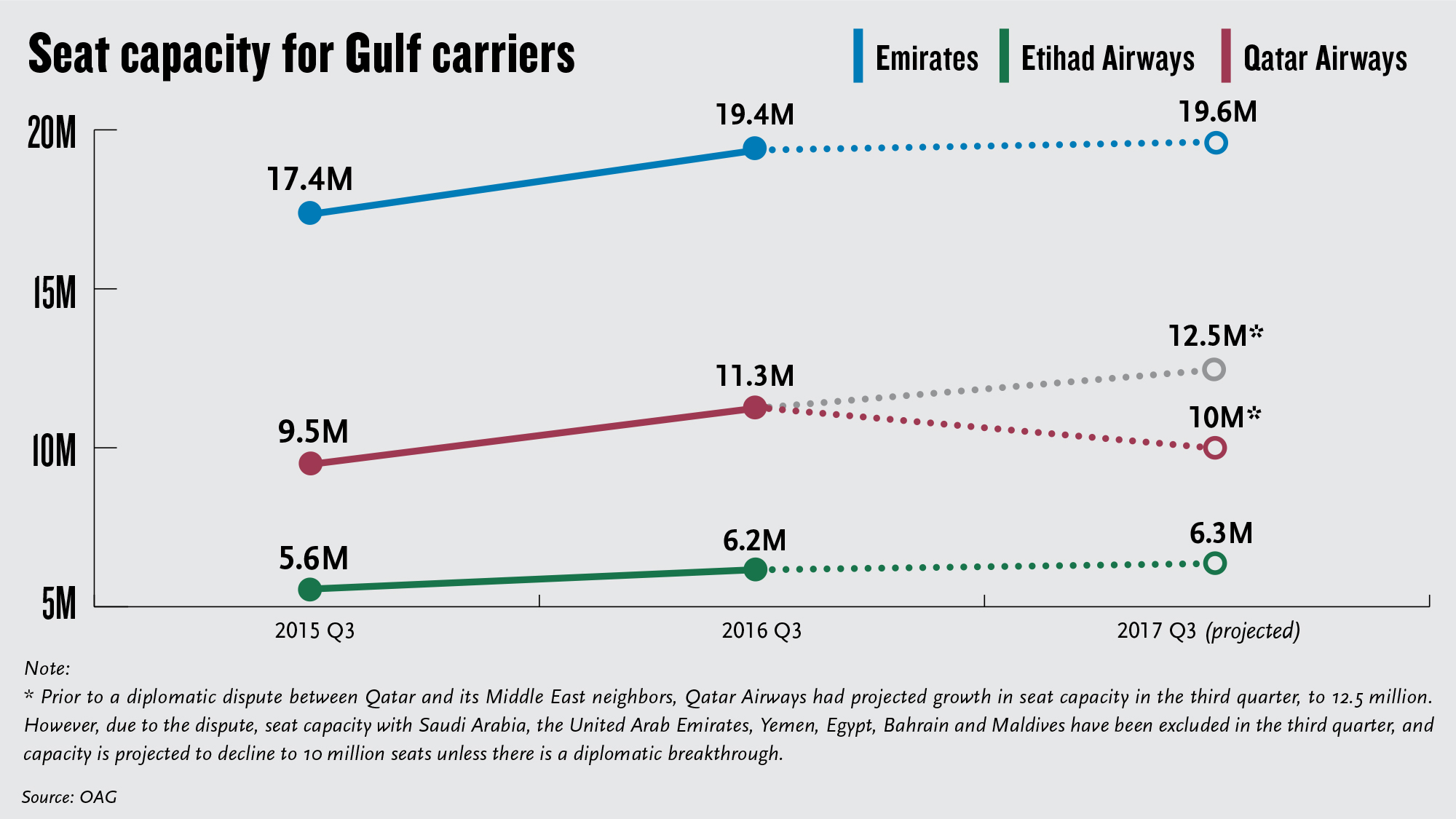

According to the aviation data analytics company OAG, Emirates is slated to fly just 1.1% more seats in the third quarter of this year than it did last year, compared with a growth rate of 11.5% a year earlier. Meanwhile, Etihad is slated to grow by 2.7% in the third quarter, compared with the 10.8% growth it enjoyed in the third quarter of last year.

Both carriers have announced hits to U.S. routes, with Etihad canceling San Francisco service beginning in October, and Emirates, between May and the beginning of this month, having reduced frequencies on five of its 12 U.S. routes.

Qatar, which has continued to aggressively grow even in the face of toughening business conditions, had planned to fly 10.5% more seats this quarter than it did a year ago. But if the Gulf region’s diplomatic dispute continues through September, the carrier will actually see seat capacity drop by 11.1%, according to OAG forecasts.

Meanwhile, at least two of the three Gulf carriers are seeing sagging financial results. Analysts said that the third carrier, Etihad, likely is as well, but it hasn’t issued an earnings statement since 2015.

In May, Emirates reported a profit margin of just 1.5% for the fiscal year that ended in March, down from a margin of 8.4% a year earlier. Profit fell 70.8%, to about $670 million. Yields, defined as the amount of revenue earned per seat, per mile flown, fell 7.2%. Emirates blamed increased competition and overcapacity in numerous markets for the decline. The strong dollar and toughened regulations put in place by the Trump administration were also factors, the company said.

In June, Qatar reported that it made a net profit for the fiscal year that ended March 31 of $693 million, a 21.7% year-over-year increase. But according to Airline Weekly managing partner Seth Kaplan, who has analyzed the report, Qatar didn’t include labor costs or depreciation in its expenses line, as is standard industry practice. With those costs included, Qatar had an operating margin of minus 3%, Kaplan said, ranking it 72nd out of 75 airlines in Airline Weekly’s recent Global Earnings Scorecard.

A long-term slowdown for the Gulf carriers could have major implications for Boeing and Airbus. Between them, the three airlines have 358 outstanding orders with Boeing and 258 with Airbus, according to the companies’ respective websites.

Late last year, Emirates deferred delivery of 12 Airbus A380s, an ominous development for the future of the world’s largest passenger aircraft. Emirates has been Airbus’ dominant A380 customer, having placed 142 of the 317 total purchase orders for the plane.

“They seem to have decided to kill the A380,” Richard Aboulafia, an aircraft industry analyst with the Fairfax, Va.-based Teal Group, said of Emirates.

Boeing, too, is vulnerable, Aboulafia said, noting that more than 70% of its order sheet for the next generation 777X is from Gulf carriers.

“That’s a hell of a lot of reliance on a region that seems to be teetering on the brink,” he said.

Yet John Strickland, owner of the London-based airline industry analyst firm JLS Consulting, said that faced with this series of difficulties, the Gulf carriers are beginning to adjust.

Aside from deferring A380s and slowing growth, for example, Emirates has said it is seeking to cooperate more closely with the low-cost carrier FlyDubai. Such a move would help Emirates diversify, since FlyDubai has the narrowbody aircraft in its fleet that Emirates lacks.

Meanwhile, Etihad Airways Group CEO James Hogan, who was the architect of the carrier’s strategy to invest heavily in other airlines, departed at the beginning of this month. Etihad must still select a new CEO who will wrestle with the fallout from the Alitalia bankruptcy and the foundering fortunes of Air Berlin, which has lost $1.3 billion over the past two years, Strickland said.

Difficulties aside, CAPA’s Horton remains bullish on the long-term prospects of the Gulf carriers.

“[What] is not going to eventuate is the sharp slowdown or even contraction that is wished for by Lufthansa, Air France and Singapore Airlines,” Horton wrote in an email. “It should not even be a dream. To the contrary, Gulf airlines are more in control of their costs and sit in growth regions. They can reform and restructure. The prospect of more capable Gulf airlines should keep competitors awake.”

Strickland struck a similarly bullish note.

“The 21st century, I think, is still largely their century because of the technology capability with the aircraft they have,” he said, referencing their modern fleets. “And with the location they are in, they can serve the world nonstop or one-stop.”

Sоurсе: travelweekly.com