You might also like:

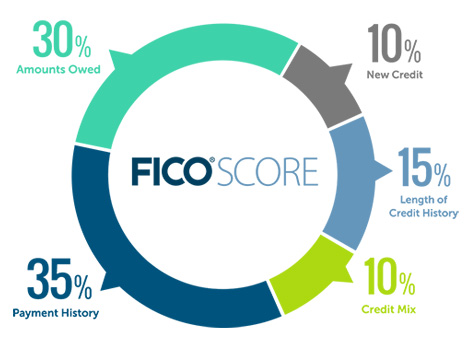

If credit cards are part of your points and miles strategy (as they should be), you’re probably aware of the recommended way to close out any unneeded credit card accounts with minimal impact to your credit score: Just pay off the card balance to zero and sustain the same overall credit utilization rate after giving it the axe. But considering that the length of your credit history — your Average Age of Accounts (AAoA) — makes up 15% of your FICO score, how do closed accounts contribute to the average? And does their clock stop ticking as soon as they’re terminated?

How the Average Age of Accounts Works

The Average Age of Accounts is calculated just like the term suggests — it’s an average of the length of time that has passed since the open date for each one of your accounts. Take the following simple example:

- Credit Card 1: Open for 15 months

- Credit Card 2: Open for 36 months

- Credit Card 3: Open for 3 months

Your AAoA in this case would be the total time that has passed since opening each credit card in months (15+36+3) divided by the number of accounts (3). This gives you an AAoA of 18 months.

Now, let’s say you decide to close Credit Card 2, which you’ve had open for 36 months, because you don’t want to pay the annual fee. To keep your utilization rate stable, you open a new card when you cancel the older one. Six months later, your itinerary of accounts looks like this:

- Credit Card 1: Open for 21 months

- Credit Card 2: 42 months old (Open for first 36 months, closed past 6 months)

- Credit Card 3: Open for 9 months

- Credit Card 4: Open for 6 months

Once again, the AAoA would be the total number of months since opening each card (21+42+9+6) divided by the number of accounts (4), which yields an average of 19.5 months.

In other words, closed accounts do count toward the growth of credit history length — aging normally month by month and year by year — until they’re deleted from credit reports 7-10 years from the date of closure or last reported account activity, whichever is later.

Avoid Closing the Oldest Accounts

However, while closing a credit card won’t impact AAoA right away or even in the long term, if you close a card that’s significantly older in comparison to your other ones, it could lower your average age when it eventually falls off the credit report, and as a result lower your scores.

If you fast-forward our example by 9.5 years (114 months) to when Credit Card 2, the older account, would finally disappear from the reports, the overall AAoA would reduce by 6.5 months. This is why it’s advisable to refrain from closing your oldest credit card account, if possible.

Lastly and confusingly enough, some credit-scoring models may only use the average of open and active accounts. One of these models is called the Vantage Score 3.0 (developed by the three major credit bureaus to compete with FICO), as well as the ones used by many websites that provide free credit scores. But the FICO score, which is still used in more than 90% of lending decisions by banks, allows both open and closed accounts to age simultaneously, thereby reducing negative repercussions of opening and closing accounts to accumulate sign-up bonuses.

Bottom Line

Closing a credit card account won’t affect your Average Age of Accounts for your FICO score too significantly — especially if you open another one to keep the utilization rate stable. That said, keeping your oldest accounts open is definitely a good idea, since after 7-10 years from the date of closure, those will no longer count toward the length of your credit history.

For more information on building and maintaining your credit score, see these posts:

Source: thepointsguy.com