You might also like:

With over 4,000 properties in about 80 countries, Marriott is easily among the largest hotel chains in the world — and it’ll soon be even bigger. Despite (or perhaps because of) its immense size, it may not need to have the most compelling rewards program (which helps to explain its upcoming acquisition of Starwood). Earlier this week, I covered the top cards for Hilton-loyal travelers, and in today’s post, I’m looking at how fans of the Marriott brand can select the best possible credit cards to maximize rewards.

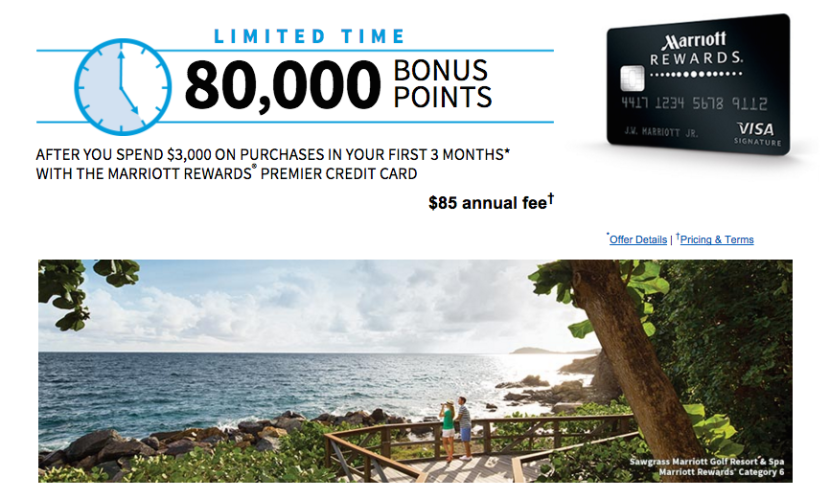

This card, which comes in both personal and business versions, is currently offering new applicants a sign-up bonus of 80,000 points after they spend $3,000 in purchases within three months of account opening. There’s also an opportunity to earn an additional 7,500 points for adding an authorized user who makes a purchase in the same time period, so you’ll earn over 90,000 points after earning both of these bonuses (counting the points earned from meeting the minimum spending requirement).

Cardholders earn 5x points for spending at any of the Marriott brands; 2x for airline, rental car and restaurant purchases; and 1x elsewhere. That said, according to TPG’s latest valuations, Marriott Rewards points are worth 0.7 just cents each, so this isn’t a card I’d want to use for everyday spending.

Instead, this product offers Marriott guests considerable perks. You immediately receive 15 credits toward elite status when you open an account, and then again each year on your account anniversary. This guarantees you Silver elite status, which offers priority late checkouts, a 20% bonus on base points earned and a few other discounts. In addition, you’ll earn an additional night stay’s credit toward elite status for every $3,000 you spend on the card. Finally, you receive a free night’s stay in a Category 1-5 hotel each year after your account anniversary. There’s an $85 annual fee for this card, and no foreign transaction fees.

The Ritz-Carlton Rewards Credit Card

Ritz-Carlton is one of the brands owned by Marriott, and you can redeem your points from either program for award stays in the other. That said, you can only be a member of one of the two programs at any given time. For more information about this, see TPG’s recent post Should I Join Marriott Rewards or Ritz-Carlton Rewards?

If you sometimes stay at Ritz-Carlton properties and you choose to be a member of its Rewards program, you should consider this card. It offers new applicants two nights at a Tier 1-4 Ritz-Carlton hotel after you spend $4,000 within three months of account opening. You’ll also receive 5x points at Ritz-Carlton and Marriott properties; 2x for airline, car rental and restaurant charges; and 1x on everything else.

Other benefits include a $300 annual air travel credit, $100 hotel credit on paid stays of two nights or longer and three complimentary upgrades to the Ritz-Carlton Club Level each year. It also includes a Lounge Club membership, Gold Elite status (which you maintain by spending $10,000 on your card each year) and a 10% annual bonus on points earned through your card. There’s a $395 annual fee for this card, and no foreign transaction fees.

Chase Sapphire Preferred Card

While the Marriott and Ritz-Carlton cards offer valuable perks for Marriott guests, the value of the rewards offered for spending are lacking at best. This is where the Sapphire Preferred comes in. It offers 2x Ultimate Rewards points for all dining and travel expenses including charges at Marriott and other hotels as well as any purchases from travel agents, cruise lines and train operators. According to TPG’s valuations, Ultimate Rewards points are worth 2.1 cents each, so this card would be a better choice than the Marriott cards anywhere but at a Marriott property. These points are so valuable because they can be transferred to Marriott Rewards and several other airline and hotel programs, giving you much more flexibility for redeeming your rewards.

Currently, new cardholders receive 50,000 points after using their card to spend $4,000 within three months of account opening. They can earn an additional 5,000 points for adding an authorized cardholder who makes a charge within the same three months. There’s a $95 annual fee for this card that’s waived the first year, and no foreign transaction fees.

Chase Ink Plus Business Card

This business card is another way to earn valuable Ultimate Rewards points for transfers to Marriott or any of the program’s other travel partners. It offers an unparalleled 5x rewards on office supply store purchases and telecommunications purchases including all television, telephone and internet service on the first $50,000 spent each account anniversary year as well as 2x gas stations and hotels (also on the first $50,000 spent each year).

New applicants can currently earn 60,000 bonus points after spending $5,000 within the first three months of account opening. There’s a $95 annual fee for this card, and no foreign transaction fees.

Chase Freedom

The Chase Freedom is a very popular cash back card, but most people don’t realize that it can also be used in combination with other cards to earn Ultimate Rewards points for transfer to travel partners. It offers 1x points on most purchases, but 5x on up to $1,500 spent each quarter at select categories of merchants. For instance, during the second quarter of 2016, the eligible categories include grocery stores (not including Walmart and Target) and wholesale clubs.

Currently, new cardholders can earn $150 back (or 15,000 points) after spending $500 in the first three months of account opening. There’s no annual fee for this card, but there is a 3% foreign transaction fee imposed on all charges processed outside of the United States.

Chase Freedom Unlimited

Chase offers this new version of the Freedom card alongside the standard Chase Freedom Card. With this version, there are no rotating bonus categories, just a simple 1.5x on all purchases with no limits. This makes the Freedom Unlimited Card suited for people who don’t like to keep track of ever-changing bonus categories, and it’s also great for purchases that don’t qualify for any bonus, since the return on everyday purchases is relatively high. As with the regular Freedom card, you can convert cash back to Ultimate Rewards points if you have an UR-earning Chase card.

This card currently offers the same sign-up bonus as the original Chase Freedom: $150 back after spending $500 in the first three months. There’s no annual fee for this card, but there is a 3% foreign transaction fee.

Citi Prestige Card

For Marriott guests, the Citi Prestige Card offers both a way to diversify reward points and a dramatic discount on paid stays. The card gets you a 4th night free on any consecutive four-night paid stays booked through Citi’s travel agency. Best off all, you can still enter your Marriott Rewards number to your reservations so that you can receive points for staying, night credits toward elite status and any benefits that you may be entitled to as a Marriott elite.

Other cardholder perks include access to American Airlines Admirals Clubs (when you’re traveling on AA) and the Priority Pass Select airport lounge program, a $250 annual air travel credit and a $100 fee credit toward the application fee for the Global Entry or TSA PreCheck programs. You also earn 3x points for purchases from airlines and hotels, 2x on dining and entertainment and 1x on all other purchases.

TPG values Citi ThankYou points at 1.6 cents each, so you’d be earning rewards worth about 4.8 cents when you use your card to book Marriott properties. This compares favorably to the 3.5 cents in value offered by the Marriott cards (5x Marriott Rewards points valued at 0.7 cents apiece). And this is on top of the value you’d receive from the 4th night free offer.

In addition, the ThankYou Rewards program lets you transfer points to airline miles, mostly at a 1:1 ratio, or to the Hilton HHonors program at a 1:1.5 ratio. You can also redeem your points for 1.6 cents each toward airfare purchased from American Airlines, or 1.33 cents each toward tickets from other carriers. This card currently offers a sign-up bonus of 50,000 points to new applicants who spend $3,000 within the first three months of account opening. There’s a $450 annual fee for this card, and no foreign transaction fees.

Citi ThankYou Premier Card

This card offers 3x rewards on all travel, including gas, 2x on dining and entertainment and 1x on all other purchases. As with the Citi Prestige Card, the advantage for Marriott guests is that these points can be transferred to airline miles or the Hilton HHonors program, which allows you to further diversify your rewards. Points can also be used for travel reservations booked through the ThankYou Travel Center, but they are only worth 1.25 cents when redeemed this way.

Currently, new cardholders can earn 40,000 bonus points after spending $3,000 in the first three months. There’s a $95 annual fee for this card that’s waived the first year, and no foreign transaction fees.

Choosing The Right Cards for You

Regular guests at Marriott properties should definitely have either the Marriott Rewards Premier Credit Card or the Ritz-Carlton Card in order to enjoy Silver or Gold elite status and reach the next level more quickly. In addition, it helps to complement that card with another travel rewards card that earns Chase Ultimate Rewards points or Citi ThankYou Points. In particular, the premium Citi Prestige would be an excellent choice if you can maximize the incredibly valuable 4th night free benefit.

It could also be worth earning points in the Chase Ultimate Rewards program due to its strong selection of partners, many of which offer instantaneous transfers. To be clear, Marriott points are among the least valuable of the Ultimate Rewards transfer partners, but this option can be useful when you just need a few thousand points to top off your account to redeem an award.

By taking into account the benefits and drawbacks of these cards, Marriott guests can choose the right ones for their specific needs.

Source: thepointsguy.com